Guaranteed home equity line of credit for bad credit

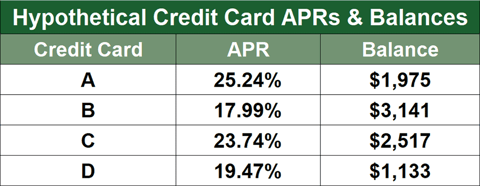

Bad credit loan interest rates start at about 20 but can rise much higher. Bad credit mortgages are often.

Home Equity Line Of Credit Heloc Rocket Mortgage

UK Bad Credit Loans help you secure loans and do not care for previous defaults or charge-offs.

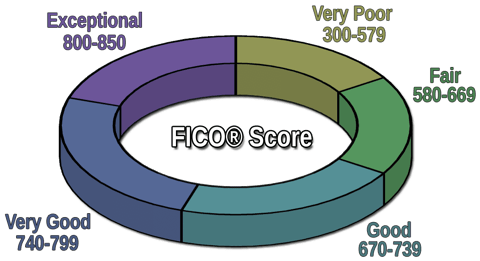

. If you have bad credit you may still be able to get a home equity loan since the loan is backed by. Over the last couple of years many no-credit-check lenders have emerged in the lending market. Credit bureau Experian doesnt use the term bad credit but it does consider any score below 580 to be very poor credit.

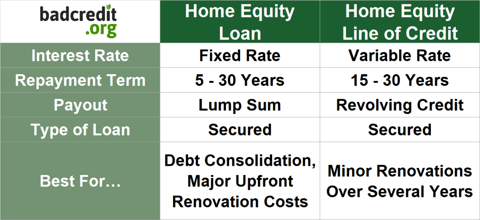

Your credit score is one of the key factors in qualifying for a home equity loan or a home equity line of credit HELOC. Home equity line of credit HELOC Because a HELOC is a secured loan backed by your home you can qualify for lower interest rates than you would for an unsecured personal loan. The minimum deposit for Discover it Secured Credit Card 200 is on.

The Credit One Bank Platinum Visa for Rebuilding Credit is a pretty good unsecured credit card for people with bad credit. You can use the line of credit to pay for home improvement projects or any other large expense and make payments over as many as 30 years to satisfy the loan. Interest rates on equity lines of credit are lower compared to other loans.

One of the advantages of using a home-equity loan is you can deduct the interest that you pay on the loan from your taxable. To report your Visa Debit Card lost or stolen after hours please call 800 472-3272 option 2. You may be able to take out a home-equity loan and use the money to pay for your college education.

Home equity loans allow property owners to borrow against the debt-free value of their homes. The Discover it Secured Credit Card is 2022s best secured card because it has a 0 annual fee and gives good rewards on purchases 1 to 2 cash back. Rates points and programs cannot be guaranteed and are subject to change without notice.

No credit check loans are credit-related products that allow users to access quick funding without undergoing a credit check. The more equity you have in your. Banks will usually reject borrowers with bad credit.

Home Equity Line of Credit Second home 600-750. Average credit scores range from 580 to 669. With a large number of Americans unprepared for financial emergencies these types of loans are becoming increasingly popular.

Youll find UK credit cards from major banks. Supervisiory Committee PO Box 49881 Greenwood SC 29649. The Discover it Secured Credit Card is also worth it because it doubles the rewards cardholders earn the first year.

These poor credit loans help provide you with the emergency cash needed in times of emergency. For home equity loans the lender uses your home as security. On a home equity line of credit HELOC you can get a maximum of 65 of your homes appraised value.

This can be a good option to consider if you are a homeowner and you have some equity in your house. It also offers cash back rewards and monthly. To contact the Supervisory Committee please mail to NUFCU ATTN.

253279345 To report your Visa Credit Card lost or stolen or for 24 hour member service please call 866 422-8617. Borrowing money with bad credit is made possible. Youll be issued a line of credit from a bank that is secured by your home.

UK Bad Credit Loans also offers short-term loans with no credit check. Find the bad credit credit cards most likely to accept you. The Credit One Visa Card can be worthwhile because it gives users a 300 initial spending limit with no security deposit needed in return for up to 99 in annual fees 75 the first year.

Help repair your poor credit score and compare our best credit cards for bad credit. If you can improve your credit score you should be able to access loans starting at about 7. Loans subject to all credit union policies and procedures.

The lower the score the more likely you are to be charged a higher interest rate. A home equity line of credit HELOC works similarly to a credit card. Bad address returned mail 5 per occurrence.

You get a higher credit limit which is useful on higher interest loans. Call center account inquiry. A FICO score of at least 680 is typically required to qualify for home equity loans according to Experian one of the three major credit.

Good credit scores begin at 670. You can expect worse rates if you are getting a bad credit loan in Canada compared to borrowers with fair or good credit.

Small Business Loans For Bad Credit Bad Credit Business Loans Home Improvement Loans Small Business Loans Business Loans

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

Pin On Swimming And Safety Tips

Can I Get A Home Equity Line Of Credit With Bad Credit Credit Karma

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

How To Get A Home Equity Loan With Bad Credit Forbes Advisor

Home Equity Line Of Credit Heloc Rocket Mortgage

Pre Approved Car Loans For Bad Credit Helps Bad Credit Car Buyers To Get Behind The Wheel

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

4 Subprime Home Equity Loans 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

How To Transfer A Home Equity Line Of Credit Balance To A Credit Card Home Equity Line Of Credit Balance Transfer Credit Cards

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

The 5 Best Second Chance Credit Card With No Security Deposit Unsecured Credit Cards Best Credit Cards Bad Credit Credit Cards